Crediting Tax

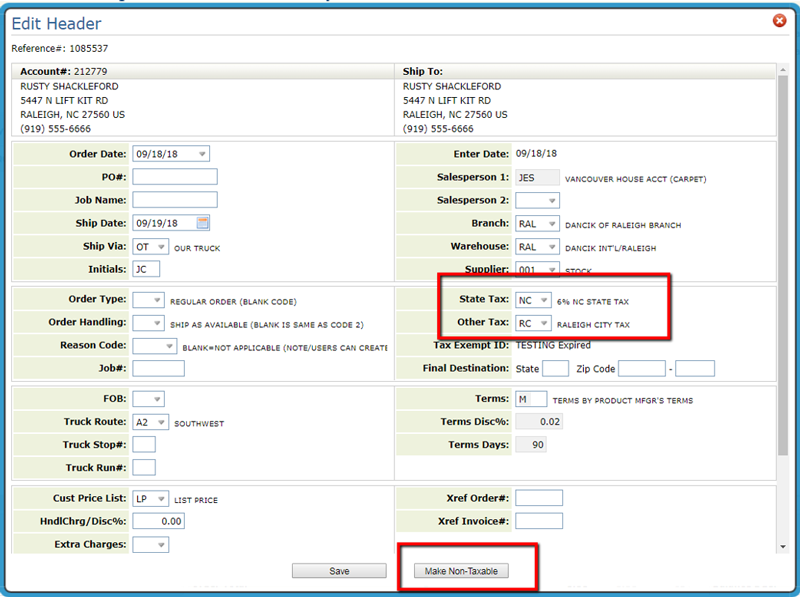

Enter the order and make sure the same tax codes that appeared on the incorrect order appear in the header of the order. This is important to ensure that the tax amount that is credited is the same as the tax amount that was charged. If the order begins as non-taxable, you can use the tax toggle icon at the bottom of the header screen to change this and then manually enter the correct tax codes.

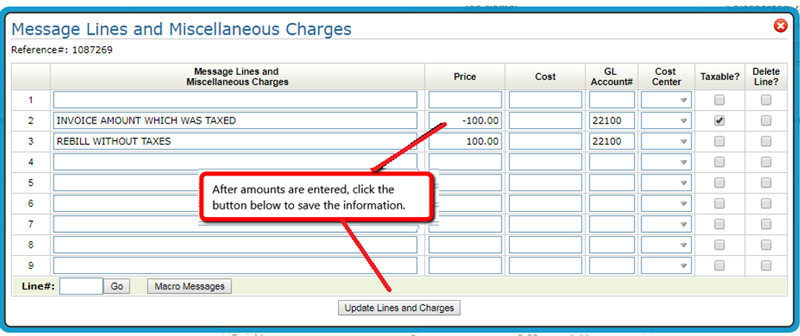

The actual charges for the order will be placed using message lines. The first line you enter will be the total amount of the incorrect invoice making sure that it shows negative. The second line will be the total amount of the incorrect invoice but as a positive number. Be sure NOT to check or uncheck the Taxable boxes yet. This step will come next. Once the lines are entered and have the GL accounts and cost centers that will be affected, click Update Lines and Charges.

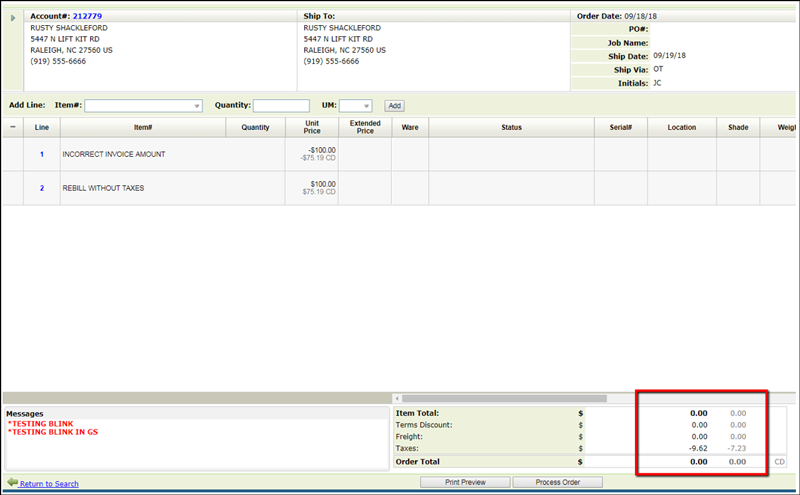

The information will reload onto the order and then you will see a tax credit appear at the bottom of the order.

Once the order is showing the correct tax credit amount it will need to be invoiced individually by the order number. The invoice will then appear on the customer account to be applied against any existing charges.